For years it was assumed that tax planning was reserved for the wealthy. While wealthy individuals will see the most benefit from tax planning, with big changes

One of the building blocks of a strong Financial Plan is your Emergency Fund: Do you have one? If not, do not think you are immune to the financial perils that

In our last blog, we talked about methods for cleaning out unwanted items and turning them into cash. Craigslist and eBay are two of the most popular “middle

Whether we want to admit it or not, we all have a pile of items we don’t use anymore – an old dresser, a digital camera that has been replaced by your cell

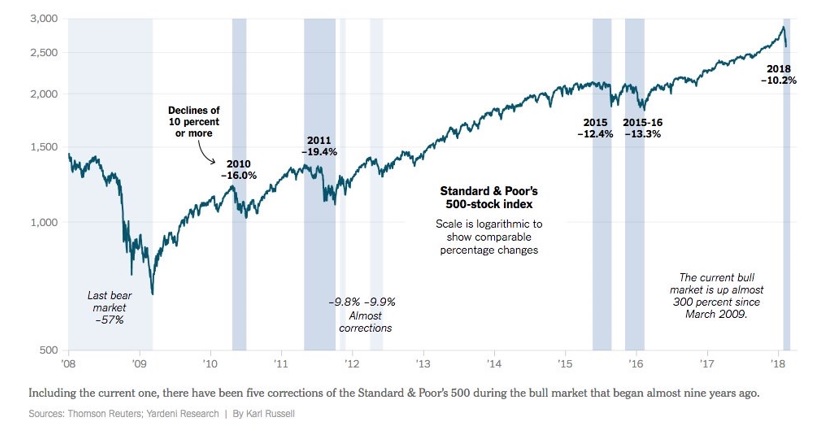

“The market will go up and it will go down, but not necessarily in that order.”

J.P. Morgan

Buckle your seatbelts, volatility is back. After the most placid

We have all been told that disciplined saving is the key to financial success. While it sounds simple in concept, the reality is a little more complex. How much

We’re all familiar with fitness fanatics, raving about life changing workouts guaranteed to get you into tip top shape. While there are always new fitness

It is no secret that we’re big on 529 plans as investment vehicles to assist with higher education costs, especially since it is possible that the new Tax Cuts

My favorite subject at the moment is Amazon. The company that spent the first decade of its life devoted to selling paperbacks over the internet has quietly (or

The final part of our “investment basics” series will cover the wild world of hedge funds. Hedge funds get a lot of press for their high fees, big-ego portfolio

A former colleague was fond of saying, “there are five different places you can put your money: stocks, bonds, real estate, cash, and commodities.” We’ve

Continuing our Financial Empowerment series, this blog article introduces our readers to the world of fixed income.

What is a bond? To keep things simple, a